Online marketplaces like Amazon, Walmart and Target are investing heavily in their online and logistics infrastructure to acquire more online consumer spend. Digital brands that are balancing .com and broader marketplace investments are winning and acquiring more customers.

Marketplaces have been around for hundreds of years as a place for people to procure, trade and sell goods and services.

However, in 2020 the biggest marketplaces in the world are no longer in city centers. They’re not in shopping malls or retail conglomerates, either. They are in your pocket, at your fingertips.

Amazon, eBay, Walmart, Target, Wayfair, Newegg, Zappos, 6PM, Zulily, Bonanza, Etsy, Overstock, Rakuten, Facebook, and the list goes on. Online marketplaces selling a variety of goods have been here for a long time and are here to stay. Recent global events are only accelerating the shift of sales from retail to online.

Many direct-to-consumer ecommerce brands have traditionally been protective of their .com address. It’s their best opportunity to control their narrative, show off their products, and retain the highest margin on sales. Brands usually try to keep the majority of digital investments fo- cused on .com traffic and have historically been wary of marketplaces like Amazon in regards to diluting brand equity and cannibalizing sales from .com.

At Markacy, we have observed this perspective shift as our clients now realize that online mar- ketplaces provide tremendous value and large existing customer bases to tap into. They serve as a great way to de-risk around fluctuating wholesale demand, and serve as owned vehicles to push inventory that .com itself cannot convert through existing traffic.

Brands that do not have a strong marketplace strategy are missing out on an enormous exist- ing customer base that can fuel digital sales growth and brand awareness. The next frontierin ecommerce is going to be a shift from managing .com sales to balancing optimization and investments across .com, Amazon, Facebook and other marketplaces—all of which will be able to be branded in the same way that .com is to maintain brand equity.

Industry Trends

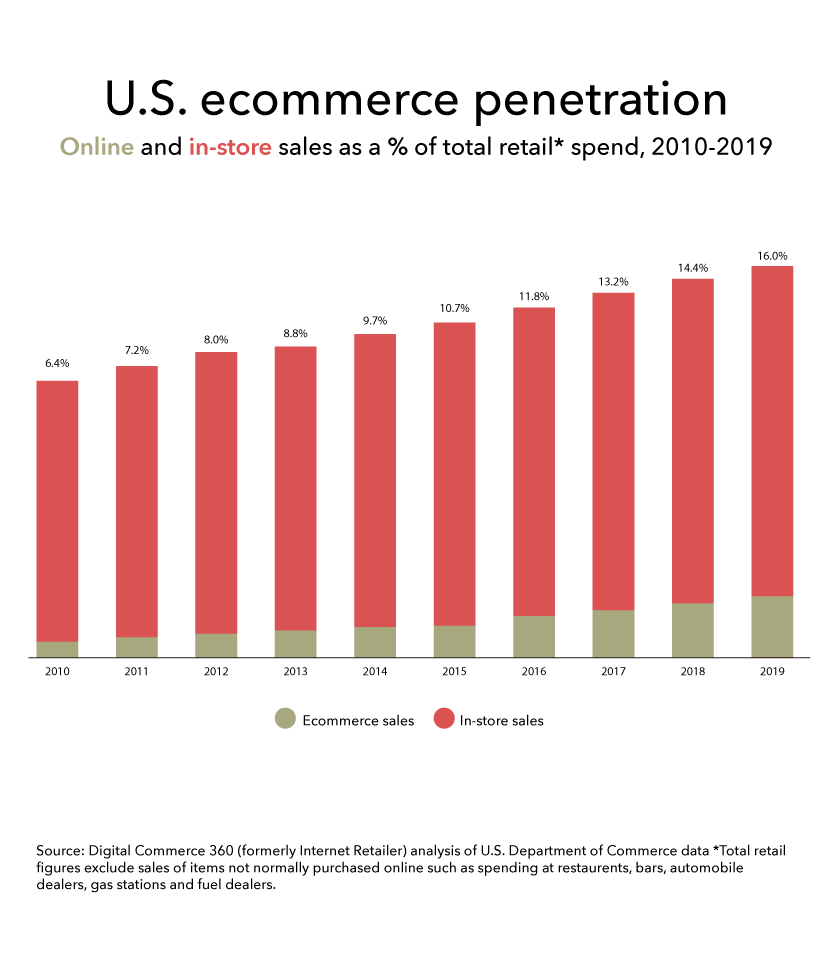

According to the U.S. Department of Commerce quarterly ecommerce figures for 2019 consumers spent $601.75 billion online with U.S. merchants, up 14.9% from $523.64 billion the prior year. What this shows

is the growing demand and preference for direct-to- consumer shopping.

And it doesn’t stop there: iBe, a European financial services advisory firm, forecasts that B2C marketplaces are currently responsible for over $1 trillion of marketplace sales and could be worth an estimated $3.5 trillion by 2024, accounting for more than 70% of all online B2C sales.

These trends are consistent with Amazon’s recent reporting for Q1, 2020. Amazon reported that net sales from its online stores totaled $36.7 billion in the quarter, jumping up 25% year-over-year—its highest quarterly sales growth in over 3 years.

What makes this even more noteworthy is that Amazon placed various restrictions on its services to adjust to the COVID-19 pandemic and the surge in demand for essential products. This suggests that these types of increases in online demand will continue as consumers navigate a new normal for direct-to-consumer shopping preferences.

These types of increases in

online demand will continue as consumers navigate a new normal for direct-to-consumer shopping preferences

Marketplaces in the Spotlight

Amazon’s CEO Jeff Bezos noted in the company’s Q1 earnings release that they plan to spend billions of dollars in Q2 to adjust to the pandemic and to protect employees with PPE and social distancing measures so that the company can keep up with growing demand.

Another example: Walmart’s ecommerce sales in the U.S. shot up by 74%, and same-store sales grew by 10% in Q1. The retailer also announced that it is phasing

out the Jet.com brand, which Walmart bought for $3.3 billion in 2016 to speed its ecommerce strategy and better position the brick-and-mortar giant to compete with Amazon.

Doug McMillon, the company CEO, said the company hasn’t ruled out using the Jet.com brand name in the future, but said he’s seen the Walmart name “resonate regardless of income, geography or age.”

Target also reported that digital comparable sales

grew 141% during Q1, 2020. They also revealed that digital comparable sales accelerated every month in the quarter, from 33% in February to 282% in April. Same- day services (Order Pick-Up, Drive-Up, etc.) also grew by 278%.

While these recent trends can be seen as an outlier due to the recent pandemic, digital leaders should pay attention. While retail will reopen at some point, consumers will likely prefer social distancing forms of commerce for the next 12-18 months.

We recommend starting with a competitive analysis to see where similar products and competitors exist, and take action quickly if opportunities exist.

How Brands Can Get Started

Fortunately, launching your marketplace strategy has never been easier. Amazon has invested heavily to make sure that it is as seamless as possible for brands to set up branded seller stores, ship inventory to Amazon logistics facilities nationwide, and start selling and advertising their products.

Walmart and Target are also building out their internal advertising teams, Walmart Media Group and Roundel. Both exist to help the companies catch up to Amazon’s growing lead in the marketplace category.

Choosing the Ideal Marketplace

Determining your marketplace strategy depends on which industry you are in and what your goals are for the channel. If you are in the CPG industry (like most of our clients), you have plenty of options and Amazon, Walmart and Target are good ones to look at. However, if you are in a more niche category, like the pet space, you might also look at Chewy. If you are in the automotive industry, you would be exploring eBay. If you sell personal care items, pay attention to the recent announcement of CVS Media Exchange.

There isn’t a one-size-fits-all strategy for marketplaces. They allow brands to tap into more intent-driven consumers, which can be limited on Google or Bing. Customers shop on Amazon, Walmart and Target in the same way they do on search – searching for things they need. Fashion, apparel and accessory brands that cycle through many new collections and seasonal items may look to marketplaces as liquidation funnels for past season goods. With this strategy, you’ll typically protect your .com as the sole platform for new arrivals. Whereas other brands in the personal care space might sell all their same products on .com and Amazon.

We recommend starting with a competitive analysis to see where similar products and competitors exist, and take action quickly if opportunities exist.

“Our goal is to make shopping seamless and empower anyone from a small-business owner to a global brand to use our apps to connect with customers.”

-Mark Zuckerberg

Consider Your Long-Term Strategy

Marketplaces are also great because you have the option to do 1PL or 3PL options. The beauty of Amazon, Walmart and Target is they have massive existing logistics capabilities. As brands look to scale, marketplace inventory considerations should also be scoped as they can act as a hedge against growing warehouse or 3PL costs.

For instance, with Amazon, most brands leverage Fulfillment By Amazon (FBA), as it’s the only way you can sell your products as “Prime” certified. Basically, Amazon wants to own your inventory so they can manage it and get it to their Prime customers in 2 days. Amazon does not allow Prime shipping for its Merchant-Fulfilled option where the brand is responsible for shipping.

There are also many feed management tools like Feedonomics that make it easy to connect your .com product feed to Amazon, Walmart, eBay, Google, Facebook, etc.

Overall, brands need to start having strategic marketplace discussions to see what makes sense for the remainder of 2020 and beyond. You don’t want to be left behind by another competitor that got there first.

New Arrival: Facebook Shops

In March 2019, Facebook launched a beta of Instagram Checkout, allowing customers to buy products without leaving the Instagram app. Now, Facebook recently announced the launch of its customizable online storefronts called Facebook Shops, part of its quest to get customers to think about Facebook and Instagram as their go-to places to discover new products.

As Mark Zuckerberg stated during the Facebook Shops release, “Our goal is to make shopping seamless and empower anyone from a small-business owner to a global brand to use our apps to connect with customers.”

Businesses can choose which products to feature from their catalog and then customize the look and feel of their shop with a cover image and accent colors that showcase their brand. As a consumer, you can message a business through WhatsApp, Messenger or Instagram Direct to ask questions, get support, track deliveries and more. Brands should be aware of this customer service aspect to ensure they have people and processes in place to maintain these inquiries.

The company also plans to launch Instagram Shop this summer, allowing users to browse products directly from Instagram Explore and eventually jump into a shopping experience from the app’s main navigation tab.

As part of this announcement, Facebook said it’s partnering with Shopify, BigCommerce, Woo, Channel Advisor, CedCommerce, Cafe24, Tienda Nube and Feedonomics. Merchants will be able to use these third-party platforms to manage their Facebook Shops, as well as the ads tied to those Shops.

But what we find most important in the update is the direction: make selling and shopping seamless and completely personalized through AI. It’s a win for both sides and the shopping experience feels more organic. In some ways we are already there, but really it’s only the beginning.

While we expect more information to be rolled out over the coming months, it’s clear that Facebook is trying to establish itself into more than just an advertising platform. Expect Facebook to continue to invest heavily in its marketplace and

shopping experience capabilities over the coming quarters and years. In December 2019, the company acquired a startup called Package to enable live shopping videos. It has also disclosed future capabilities for 360-degree views of products and a computer vision system capable of recognizing almost any product from a photograph.

New marketplace innovations like Facebook Shop are popping up all the time, creating new opportunities for brands to get in front of new potential customers.

Our advice?

Be proactive, not reactive, and have plans in place to deal with new market innovations as your team and brand scales.