Our Blog Featuring CMO and executive marketing insights.

Advertising.

Consulting.

Consulting InsightsInsights

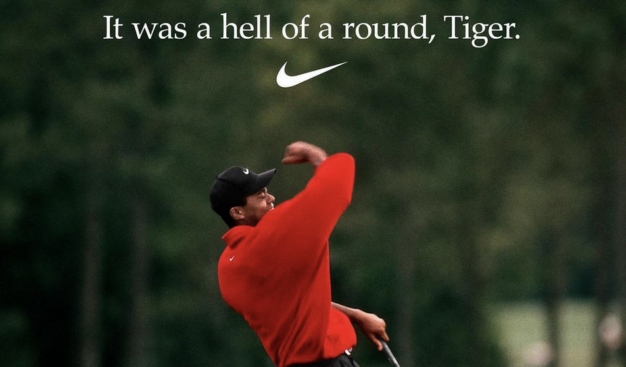

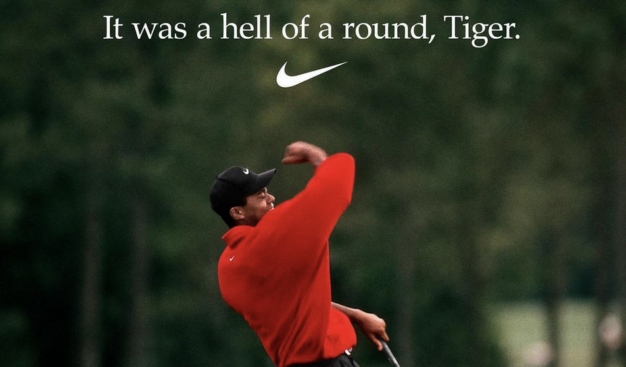

Tiger Woods | Build vs Partner

January 11, 2024

So Tiger and Nike’s decision to end their partnership wouldn’t normally prompt a note from me but there are actually some very intriguing business fundamentals to explore so I thought it was worth a post. Tiger recently announced he was ended his long-standing relationship with Nike (27 years) and would be wrapping up his recent contract […]

Consulting Insights

The Promise and Paranoia of AI: Transforming Our World and the High-Stakes Implications

November 3, 2023

By: Matt Crider – Strategy Director @ Markacy In an era marked by extraordinary innovation and boundless human potential, Artificial Intelligence (AI) has emerged as a pivotal force shaping our ever-evolving civilization. Its incredible capabilities have ignited a sense of promise and opened up new possibilities for transforming our world in ways previously only imagined. […]

Consulting Insights

Top 10 E-Commerce Trends to Plan For in 2023

December 19, 2022

While we’ve all seen the shift happening, nothing catalyzed the world of e-commerce and e-commerce trends quite like the COVID-19 pandemic. Between social distancing keeping people home and stores closed, and manufacturers switching production from consumer goods to PPE, the world saw an unprecedented switch from in-person, physical shopping to online shopping across every industry. […]

Consulting Insights

The Current State of D2C Business

December 19, 2022

The Direct to Consumer (D2C or DTC) model seems to have declined recently. The slowdown comes following several years of feverish growth, causing concerns over its viability. The result is that companies of all sizes and in all growth stages are currently reevaluating their D2C prospects. While the downward trend is of concern, D2C has […]

Consulting Insights

A Q&A From The NYC Venture Summit with Christopher Jones, Chris Rigas, Matt Crider, and Josh Haberman

December 10, 2022

Leaders in the marketing and VC communities discuss the rise & fall of the ‘grow at all costs’ mindset and review the strategies actually leading to sustained growth and investment. Christopher Jones (CJ), Managing Partner at Markacy: For many of the participants in the audience, who cover both the business and investment communities, the last […]

Consulting Insights

2021 Holiday E-Commerce Playbook

October 20, 2022

For most E-Commerce businesses, Q4 is the biggest time of the year for sales and revenue. Black Friday, Cyber Monday and Holiday shopping societal triggers help boost demand and conversion rate during these periods. November and December are typically the highest E-Commerce revenue months for many discretionary sectors such as fashion, beauty, personal care, electronics, […]

Consulting Insights

2022 eCommerce Holiday Playbook

October 12, 2022

For many retail brands, the Black Friday, Cyber Monday and Holiday promotional periods are the most consequential marketing events of the year. This Q4 push can account for significant increments of annual revenue and expense which require an escalated “all-hands on deck” approach to planning, pacing and execution. As we consider this year’s holiday initiatives, […]

Consulting Insights

The Impacts of Changing Agency Models

September 27, 2022

DTC business models have fundamentally changed how brands, agencies, and marketers interact, and this has only been accelerated by the pandemic. There are more outsourced, freelance options for agencies, more fluidity and less permanence, in employment options for marketers. Let’s examine some of these trends and explore their impacts they’re having on both brands and […]

Consulting Insights

5 CMO Priorities From eTail East 2022

August 18, 2022

Markacy joined many brands and eCommerce technology partners at eTail East 2022 in Boston, the eCommerce & Omnichannel Conference. Markacy Co-Founders Chris Jones and Tucker Matheson hosted a 3 hour workshop at the event on Digital Marketing, Branding and Content and got some insight into what is evolving in the online marketplace. Below are the […]

Consulting Insights

Why DTC Costs Are On The Rise

August 18, 2022

With companies flooding into the e-commerce channel during the pandemic and many traditional off-shore supply chains experiencing disruptions, many DTC companies have seen costs continue to rise in 2022. As the pandemic began, many companies still relied heavily on retail storefronts. While they likely already had their five-year plans in place to slowly migrate to […]

Consulting Insights

Are You Ready to Transition to Google Analytics 4?

July 7, 2022

In 2005 you might have been in college, or maybe you were in high school, excited to finally have a Facebook account. Of course, in 2005 you might have been in the early stages of your career, BlackBerry in hand. Whatever you were doing, you were using the internet for school, for connection, and for […]

Consulting Insights

Retail Rebound: How Brands Can Leverage Digital Transformation to Survive 2022

July 20, 2021

After a profitable 2019 holiday season with the National Retail Federation reporting a 14.6 percent lift in online sales, retailers were feeling optimistic about in store sales and e-commerce heading into the 2021. But illusions of a buyer boom quickly dissolved as COVID-19 upended the economy. As consumers adapted to the challenges of life in […]

Consulting Insights

The Actual Cost of Not Using a Unified Commerce Platform

June 28, 2021

Personally, we at Markacy like to lead our growth strategy with financial analysis and then apply tactics where necessary. That’s because we’ve realized that these other parts simply can’t go unignored anymore. For many retailers today, one of these parts is having a unified commerce platform, which has the ability to provide accurate and relevant […]

Consulting Insights

What’s the Deal With Cookies Right Now?

June 15, 2021

So what’s the deal with cookies? The worldwide changes in privacy regulation have put most marketers on alert and many are asking themselves how they’ll manage customer data without third-party cookies. Since marketers will no longer be able to rely on third-party data, they’ll need to start building real relationships with their consumers and a […]

Consulting Insights

E-Commerce Playbook for Startups

May 26, 2021

We’ve been thinking a lot about how today’s e-commerce brands can win… tomorrow. With e-commerce continuing to accelerate, it’s more important than ever to build a scalable business model. This means that it’s no longer enough to have a Shopify website and a Direct to Consumer (DTC) drop ship model. DTC brands need to be […]

Consulting Insights

Retail Rebound: 2023 Survival Toolbox

April 20, 2021

After a profitable 2019 holiday season with the National Retail Federation reporting a 14.6 percent lift in online sales, retailers were feeling optimistic about in store sales and e-commerce heading into the new year. But illusions of a buyer boom quickly dissolved as COVID-19 upended the economy. As consumers adapted to the challenges of life […]

Consulting Insights

E-Commerce Trends to Watch in 2022

April 20, 2021

Online marketplaces like Amazon, Walmart and Target are investing heavily in their online and logistics infrastructure to acquire more online consumer spend. Digital brands that are balancing .com and broader marketplace investments are winning and acquiring more customers. Marketplaces have been around for hundreds of years as a place for people to procure, trade and […]

Consulting Insights

Holiday E-Commerce Playbook

October 26, 2020

For most E-Commerce businesses, Q4 is the biggest time of the year for sales and revenue. Black Friday, Cyber Monday and Holiday shopping societal triggers help boost demand and conversion rate during these periods. November and December are typically the highest E-Commerce revenue months for many discretionary sectors such as fashion, beauty, personal care, electronics, […]

Consulting Insights

May 2020 CMO Letter

June 6, 2020

The COVID-19 pandemic has changed the way many brands approach marketing and customer retention. Learn how to thrive with Markacy's analysis & trends report.

Consulting Insights

Black Swan: Coronavirus And Marketing Strategy

March 16, 2020

A black swan is a term famously coined by author and statistician Nassim Nicholas Taleb in his book The Black Swan: The Impact of the Highly Improbable, as a metaphorical event, positive or negative, that is deemed improbable yet causes massive consequences. Much like the financial crisis of 2008–2009, the recent COVID-19 coronavirus outbreak has rattled the world, seemingly out of no-where. […]

Consulting Insights

Top 8 Media Trends for 2020

February 9, 2020

Life moves fast in the media and marketing world. Here, learn about the media trends Markacy predicts for 2020. Life moves fast in the media and marketing world. While in 2019 we saw Snapchat turn into a ghost town and a new short-form video app — TikTok — take centerstage, the start of 2020 has […]

Consulting Insights

How To Select The Best Marketing Partner

September 19, 2019

https://medium.com/media/d6823850ffdb2d3397d5ffc6b6bb9d96/href Business owners of all shapes and sizes struggle to find marketing partners that fit their needs. Whether you’re looking for someone to help with social media, run an ad campaign, produce video content, or build a marketing strategy, it’s always important to make sure you’re in good hands with someone you can trust. We’ve […]

Consulting Insights

Want To Build A Great Business?

September 19, 2019

Over the years, I have worked with over 750 small to medium size business owners. A few of these businesses were corporately owned, but the majority of them were family owned and operated. Many of these business owners were truly inspirational. They wanted to make a difference in the lives of their customers and the […]

Consulting Insights

Warby Parker: Customer Experience

September 17, 2019

The internet has been around since the early 1980s in its simplest form. The first eCommerce companies started popping up in the 90’s — including a few notable names like Amazon, eBay, PayPal, and Alibaba. Throughout the 1990s, 2000s and this current decade, technological advancements in supply chain, logistics, digital advertising have made direct-to-consumer operations possible for almost every industry selling shelf-stable products. […]

Consulting Insights

Warby Parker: Customer Experience Spotlight

September 17, 2019

Warby Parker was first launched in 2010 as the team finished up their graduate degrees. Warby was launched as an exclusively direct-to-consumer brand offering prescription eyewear at affordable prices.

Consulting Insights

Keep It Simple

September 14, 2019

Last week, Joe Rogan, the comedian, and UFC color commentator interviewed Elon Musk on his podcast: the Joe Rogan Experience. Following the interview, the media highlighted the meeting’s lowest common denominator (in typical fashion): “Musk smokes pot and drinks whiskey on-air” And then, they proceeded to jump on Tesla’s immediate stock price dip of 6% […]

Consulting Insights

How to Approach Your Business (And Career) Like LeBron

September 13, 2019

Many of us look at the great ones and assume they have an underlying skill or trait that serves as the differentiating factor in their success. As a society, we make this assumption across business, athletics, academics, government (well maybe not government, ha) — but effectively every field. We assume there’s a specific reason for someone’s success, […]

Consulting Insights

Mistakes Small Business Make

September 12, 2019

Creative.

Creative Insights

The Creative Marketing Cocktail

May 23, 2021

For too long, leadership teams have mentally separated “branding” from “marketing” as two different or efforts. Oftentimes managed by separate people. Unfortunately, brands that do this suffocate their ability to expand new and existing channels, because they miss out on valuable marketing data that can inform their creative decisions and testing strategies. As we’ve worked […]

Creative Insights

Content Is King

September 16, 2019

In 2009, Yeti Holdings, Inc. (YETI) the premier maker of coolers and accessories was 3 years into its journey, with annual sales of $5M. Fast forward ten years later, Yeti is now a public company with annual sales approaching $1 Billion. Talk about hockey stick growth! It started with a quality product Maynard, VP-Marketing for […]

Advertising.

Consulting.

Consulting Insights

Mistakes Small Business Make

September 12, 2019

Consulting Insights

How to Approach Your Business (And Career) Like LeBron

September 13, 2019

Many of us look at the great ones and assume they have an underlying skill or trait that serves as the differentiating factor in their success. As a society, we make this assumption across business, athletics, academics, government (well maybe not government, ha) — but effectively every field. We assume there’s a specific reason for someone’s success, […]

Consulting Insights

Keep It Simple

September 14, 2019

Last week, Joe Rogan, the comedian, and UFC color commentator interviewed Elon Musk on his podcast: the Joe Rogan Experience. Following the interview, the media highlighted the meeting’s lowest common denominator (in typical fashion): “Musk smokes pot and drinks whiskey on-air” And then, they proceeded to jump on Tesla’s immediate stock price dip of 6% […]

Consulting Insights

Warby Parker: Customer Experience Spotlight

September 17, 2019

Warby Parker was first launched in 2010 as the team finished up their graduate degrees. Warby was launched as an exclusively direct-to-consumer brand offering prescription eyewear at affordable prices.

Consulting Insights

Warby Parker: Customer Experience

September 17, 2019

The internet has been around since the early 1980s in its simplest form. The first eCommerce companies started popping up in the 90’s — including a few notable names like Amazon, eBay, PayPal, and Alibaba. Throughout the 1990s, 2000s and this current decade, technological advancements in supply chain, logistics, digital advertising have made direct-to-consumer operations possible for almost every industry selling shelf-stable products. […]

Consulting Insights

Want To Build A Great Business?

September 19, 2019

Over the years, I have worked with over 750 small to medium size business owners. A few of these businesses were corporately owned, but the majority of them were family owned and operated. Many of these business owners were truly inspirational. They wanted to make a difference in the lives of their customers and the […]

Consulting Insights

How To Select The Best Marketing Partner

September 19, 2019

https://medium.com/media/d6823850ffdb2d3397d5ffc6b6bb9d96/href Business owners of all shapes and sizes struggle to find marketing partners that fit their needs. Whether you’re looking for someone to help with social media, run an ad campaign, produce video content, or build a marketing strategy, it’s always important to make sure you’re in good hands with someone you can trust. We’ve […]

Consulting Insights

Top 8 Media Trends for 2020

February 9, 2020

Life moves fast in the media and marketing world. Here, learn about the media trends Markacy predicts for 2020. Life moves fast in the media and marketing world. While in 2019 we saw Snapchat turn into a ghost town and a new short-form video app — TikTok — take centerstage, the start of 2020 has […]

Consulting Insights

Black Swan: Coronavirus And Marketing Strategy

March 16, 2020

A black swan is a term famously coined by author and statistician Nassim Nicholas Taleb in his book The Black Swan: The Impact of the Highly Improbable, as a metaphorical event, positive or negative, that is deemed improbable yet causes massive consequences. Much like the financial crisis of 2008–2009, the recent COVID-19 coronavirus outbreak has rattled the world, seemingly out of no-where. […]

Consulting Insights

May 2020 CMO Letter

June 6, 2020

The COVID-19 pandemic has changed the way many brands approach marketing and customer retention. Learn how to thrive with Markacy's analysis & trends report.

Consulting Insights

Holiday E-Commerce Playbook

October 26, 2020

For most E-Commerce businesses, Q4 is the biggest time of the year for sales and revenue. Black Friday, Cyber Monday and Holiday shopping societal triggers help boost demand and conversion rate during these periods. November and December are typically the highest E-Commerce revenue months for many discretionary sectors such as fashion, beauty, personal care, electronics, […]

Consulting Insights

E-Commerce Trends to Watch in 2022

April 20, 2021

Online marketplaces like Amazon, Walmart and Target are investing heavily in their online and logistics infrastructure to acquire more online consumer spend. Digital brands that are balancing .com and broader marketplace investments are winning and acquiring more customers. Marketplaces have been around for hundreds of years as a place for people to procure, trade and […]

Consulting Insights

Retail Rebound: 2023 Survival Toolbox

April 20, 2021

After a profitable 2019 holiday season with the National Retail Federation reporting a 14.6 percent lift in online sales, retailers were feeling optimistic about in store sales and e-commerce heading into the new year. But illusions of a buyer boom quickly dissolved as COVID-19 upended the economy. As consumers adapted to the challenges of life […]

Consulting Insights

E-Commerce Playbook for Startups

May 26, 2021

We’ve been thinking a lot about how today’s e-commerce brands can win… tomorrow. With e-commerce continuing to accelerate, it’s more important than ever to build a scalable business model. This means that it’s no longer enough to have a Shopify website and a Direct to Consumer (DTC) drop ship model. DTC brands need to be […]

Consulting Insights

What’s the Deal With Cookies Right Now?

June 15, 2021

So what’s the deal with cookies? The worldwide changes in privacy regulation have put most marketers on alert and many are asking themselves how they’ll manage customer data without third-party cookies. Since marketers will no longer be able to rely on third-party data, they’ll need to start building real relationships with their consumers and a […]

Consulting Insights

The Actual Cost of Not Using a Unified Commerce Platform

June 28, 2021

Personally, we at Markacy like to lead our growth strategy with financial analysis and then apply tactics where necessary. That’s because we’ve realized that these other parts simply can’t go unignored anymore. For many retailers today, one of these parts is having a unified commerce platform, which has the ability to provide accurate and relevant […]

Consulting Insights

Retail Rebound: How Brands Can Leverage Digital Transformation to Survive 2022

July 20, 2021

After a profitable 2019 holiday season with the National Retail Federation reporting a 14.6 percent lift in online sales, retailers were feeling optimistic about in store sales and e-commerce heading into the 2021. But illusions of a buyer boom quickly dissolved as COVID-19 upended the economy. As consumers adapted to the challenges of life in […]

Consulting Insights

Are You Ready to Transition to Google Analytics 4?

July 7, 2022

In 2005 you might have been in college, or maybe you were in high school, excited to finally have a Facebook account. Of course, in 2005 you might have been in the early stages of your career, BlackBerry in hand. Whatever you were doing, you were using the internet for school, for connection, and for […]

Consulting Insights

Why DTC Costs Are On The Rise

August 18, 2022

With companies flooding into the e-commerce channel during the pandemic and many traditional off-shore supply chains experiencing disruptions, many DTC companies have seen costs continue to rise in 2022. As the pandemic began, many companies still relied heavily on retail storefronts. While they likely already had their five-year plans in place to slowly migrate to […]

Consulting Insights

5 CMO Priorities From eTail East 2022

August 18, 2022

Markacy joined many brands and eCommerce technology partners at eTail East 2022 in Boston, the eCommerce & Omnichannel Conference. Markacy Co-Founders Chris Jones and Tucker Matheson hosted a 3 hour workshop at the event on Digital Marketing, Branding and Content and got some insight into what is evolving in the online marketplace. Below are the […]

Consulting Insights

The Impacts of Changing Agency Models

September 27, 2022

DTC business models have fundamentally changed how brands, agencies, and marketers interact, and this has only been accelerated by the pandemic. There are more outsourced, freelance options for agencies, more fluidity and less permanence, in employment options for marketers. Let’s examine some of these trends and explore their impacts they’re having on both brands and […]

Consulting Insights

2022 eCommerce Holiday Playbook

October 12, 2022

For many retail brands, the Black Friday, Cyber Monday and Holiday promotional periods are the most consequential marketing events of the year. This Q4 push can account for significant increments of annual revenue and expense which require an escalated “all-hands on deck” approach to planning, pacing and execution. As we consider this year’s holiday initiatives, […]

Consulting Insights

2021 Holiday E-Commerce Playbook

October 20, 2022

For most E-Commerce businesses, Q4 is the biggest time of the year for sales and revenue. Black Friday, Cyber Monday and Holiday shopping societal triggers help boost demand and conversion rate during these periods. November and December are typically the highest E-Commerce revenue months for many discretionary sectors such as fashion, beauty, personal care, electronics, […]

Consulting Insights

A Q&A From The NYC Venture Summit with Christopher Jones, Chris Rigas, Matt Crider, and Josh Haberman

December 10, 2022

Leaders in the marketing and VC communities discuss the rise & fall of the ‘grow at all costs’ mindset and review the strategies actually leading to sustained growth and investment. Christopher Jones (CJ), Managing Partner at Markacy: For many of the participants in the audience, who cover both the business and investment communities, the last […]

Consulting Insights

The Current State of D2C Business

December 19, 2022

The Direct to Consumer (D2C or DTC) model seems to have declined recently. The slowdown comes following several years of feverish growth, causing concerns over its viability. The result is that companies of all sizes and in all growth stages are currently reevaluating their D2C prospects. While the downward trend is of concern, D2C has […]

Consulting Insights

Top 10 E-Commerce Trends to Plan For in 2023

December 19, 2022

While we’ve all seen the shift happening, nothing catalyzed the world of e-commerce and e-commerce trends quite like the COVID-19 pandemic. Between social distancing keeping people home and stores closed, and manufacturers switching production from consumer goods to PPE, the world saw an unprecedented switch from in-person, physical shopping to online shopping across every industry. […]

Consulting Insights

The Promise and Paranoia of AI: Transforming Our World and the High-Stakes Implications

November 3, 2023

By: Matt Crider – Strategy Director @ Markacy In an era marked by extraordinary innovation and boundless human potential, Artificial Intelligence (AI) has emerged as a pivotal force shaping our ever-evolving civilization. Its incredible capabilities have ignited a sense of promise and opened up new possibilities for transforming our world in ways previously only imagined. […]

Consulting InsightsInsights

Tiger Woods | Build vs Partner

January 11, 2024

So Tiger and Nike’s decision to end their partnership wouldn’t normally prompt a note from me but there are actually some very intriguing business fundamentals to explore so I thought it was worth a post. Tiger recently announced he was ended his long-standing relationship with Nike (27 years) and would be wrapping up his recent contract […]

Creative.

Creative Insights

Content Is King

September 16, 2019

In 2009, Yeti Holdings, Inc. (YETI) the premier maker of coolers and accessories was 3 years into its journey, with annual sales of $5M. Fast forward ten years later, Yeti is now a public company with annual sales approaching $1 Billion. Talk about hockey stick growth! It started with a quality product Maynard, VP-Marketing for […]

Creative Insights

The Creative Marketing Cocktail

May 23, 2021

For too long, leadership teams have mentally separated “branding” from “marketing” as two different or efforts. Oftentimes managed by separate people. Unfortunately, brands that do this suffocate their ability to expand new and existing channels, because they miss out on valuable marketing data that can inform their creative decisions and testing strategies. As we’ve worked […]

Let’s Talk Shop.

If you have a marketing need, we would love to see how we can help.

Partnerships & General Inquiries: info@markacy.com