For most E-Commerce businesses, Q4 is the biggest time of the year for sales and revenue. Black Friday, Cyber Monday and Holiday shopping societal triggers help boost demand and conversion rate during these periods. November and December are typically the highest E-Commerce revenue months for many discretionary sectors such as fashion, beauty, personal care, electronics, etc.

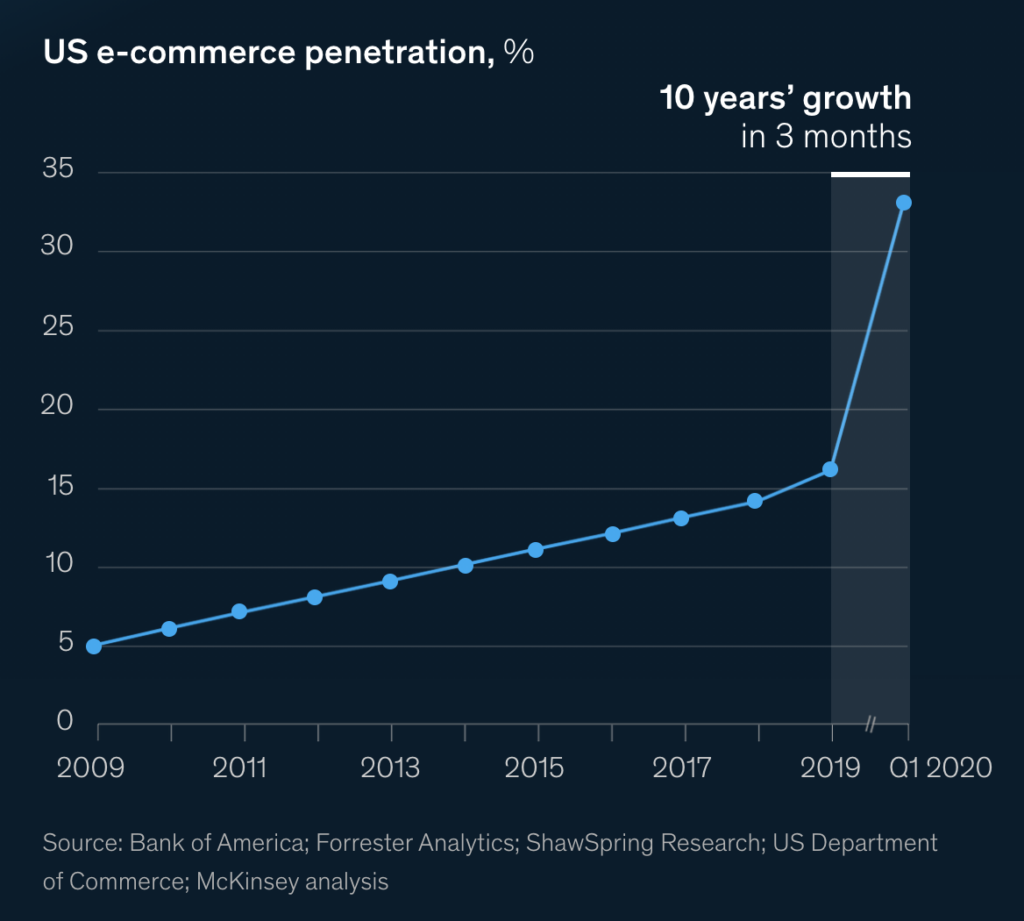

This year, we are predicting a much higher demand for E-Commerce shopping due to COVID-19 trends which have rapidly accelerated direct-to-consumer. While the transition from physical to digital commerce has long been underway, the pandemic has drastically accelerated the shift to online shopping. According to McKinsey & Company, U.S. ecommerce penetration saw 10 years of growth in three months alone.

Further, the overall COVID-19 uncertainty continues to yield consumer uneasiness with respect to in-person shopping which is likely to promote expanded interest in E-Commerce this year.

We believe these trends will make it one of the biggest quarters for E-Commerce, ever. Others are confirming the trend.

- Forrester, also sees online retail growing 18.5% this year, and to reach 20.2% overall penetration in North America.

- Salesforce predicts that up to 30% of global retail sales will be made through digital channels this upcoming holiday season.

Given the significant growth over prior years, brands need to be even more prepared with a cross-channel plan of how to maximize each day between now and shipping cut- offs for Christmas delivery (which will be earlier than prior years).

Market Trends & Key Changes

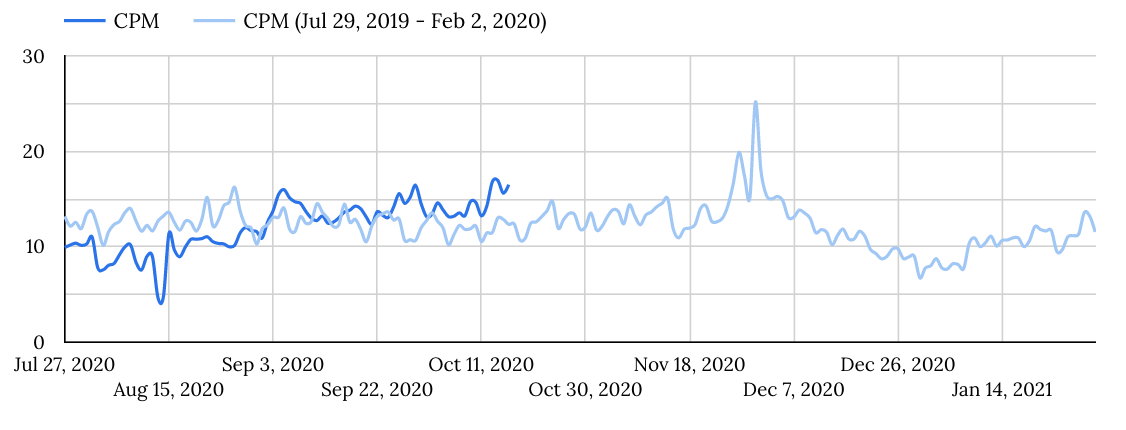

Since Labor Day, we have observed CPMs on Facebook and Google increasing dramatically. Big advertisers who may have pulled back on their marketing budgets during the initial wave of COVID-19 are now back in market and investing in acquisitions for Holiday to salvage 2020 sales forecasts.

The United States election is likely adding additional influence over national ad costs on Facebook and other social media platforms until voting day on November 3rd. eMarketer predicts that $6.23B will be spent on political advertising in 2020 – with the majority on traditional TV.

2020 vs 2019 CPMs Pacing View

This chart indicates how CPMs have risen substantially in recent weeks (even above the prior year period).

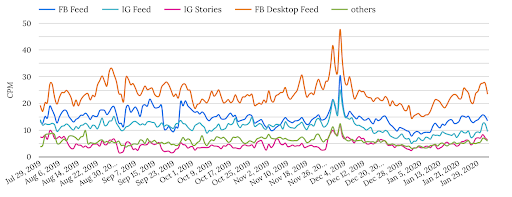

2019 Holiday CPMs by Placement

This chart demonstrates how CPMS rise considerably around the BFCM holiday period and then drop down significantly toward year-end.

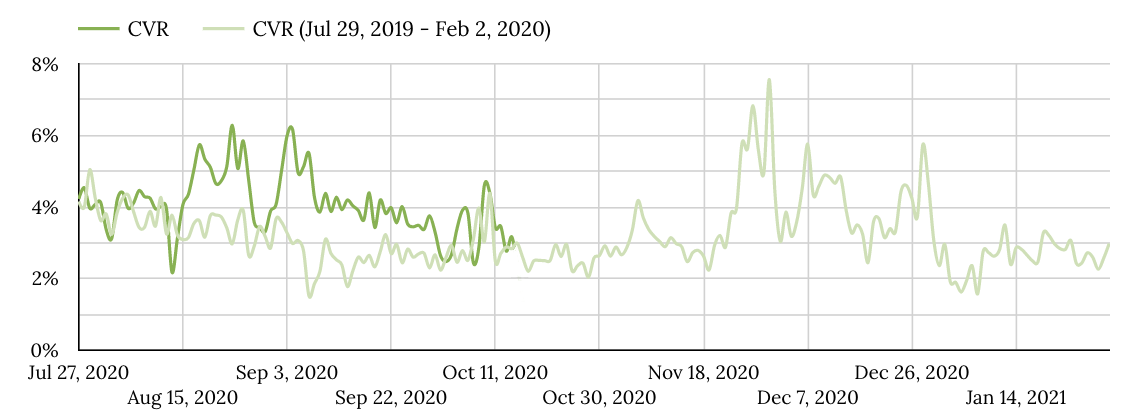

2020 vs 2019 CVR Pacing View

This chart demonstrates the fluctuation in conversion rate and expected spike around BFCM

While we expect CPMs and Customer Acquisition Costs (CACs) to stay high throughout Q4, we expect conversion rates to increase in November and December as key promotional Holidays come around and consumers pull the trigger on items they have earmarked for friends, family or themselves. What brands do between now and mid-November is critical to ensuring they get in front of as many new potential customers as possible. We will get into this further in the paid media checklist section playbook around media mix, creative and promotional strategy.

Below are some additional things brands should be aware of and planning around when setting marketing calendars, promotions, CRM communications, and advertising plans for Q4.

Black Friday & Cyber Monday Planning

- Black Friday is 2 days earlier than last year, but it is still comparatively late.

- Cyber Monday is in November this year vs. December which should impact media budgets and financial forecasts.

- There are 28 days between Black Friday and Christmas but this will be impacted by brands shipping cut-offs depending on the logistics provider.

- Like last year, many brands will likely start Black Friday promotions earlier and the week of Thanksgiving will be crowded with deals. Brands should plan on starting earlier and being aggressive.

Get Your Ship Together

Everything we have heard from across the industry is that shipping demands will be strained this year which will cause delays. It’s best to consult with all aspects of your supply chain and specifically your fulfillment providers to confirm deadlines. Below is the published guidance by FedEx and UPS but brands should be planning for delays and creating customer service response plans.

December 9: FedEx Smart Post

December 15: FedEx Home Delivery, FedEx Ground

December 16: FedEx Ground Shipping

December 19: FedEx Express Saver Shipping

December 21: FedEx Express Saver, Three-Day Freight

December 22: FedEx Two-Day, FedEx Two-Day Freight

December 13: UPS Ground Shipping

December 19: UPS Three-Day Shipping

December 23: UPS Next-Day Air Service

Strategy & Calendar Checklist

1. Holiday Creative

Figure out what themes and products your brand wants to promote this Holiday that are going to intrigue customers. What products are we promoting as gifting items, what products have done the most sales this year? Brands should be strategic around what they are promoting.

2. Promotional Calendar

Next, you need to bake those macro themes down into tactical campaigns and promotions you can roll out throughout October, November and December. Brands should develop a day-by-day calendar that showcases when certain promotions and themes start and end and what assets are needed across digital channels.

What promotions are you offering before Black Friday and Cyber Monday, during, and after to maximize pre-shipping cut-off timelines in December.

3. Content Development

Figure out what themes and products your brand wants to In order to stand out this Holiday in a crowded market, brands need to invest in digital content. This should largely be based around supporting the channels where the brand is spending the most. How are you bringing your Holiday strategy and themes to life across your website, emails, advertising, etc. Personalization and content will be key drivers of success this year.

Paid Media Checklist

Working through decades of Holiday planning for hundreds of companies, success is clear in one key area: planning. Holidays are like clockwork with slight variations every year to accommodate the latest and greatest. A decade ago, “mobile” was the newest item to worry about, then customer experience, and algorithms factoring in higher CPMs. But the constant is always planning with the following points:

-

Media Mix Strategy: cross-channel & versatility of content.

-

Promo Strategy: nailing down key dates of all sales and their variations throughout the season.

-

Creative & Messaging: Something worth advertising.

Facebook inventory grows like clockwork as we enter into the Holiday season. More advertisers in more available inventory more consistently. By Cyber Monday, consumers will see an ad every 3-5 posts yet still continue to convert.

Around Black Friday Facebook reports typically seeing CPMs peaking on our platform, but we also see conversion rates and ROAS peaking for the average advertiser. People on Black Friday are more willing to buy and, therefore, higher conversion rates and higher CPMs balance each other resulting in a roughly flat trend for CPAs. And with creative impacting the auction by up to 50%, it’s important to understand how to stand out.

Conversion and traffic generation capabilities are so strong in Facebook, especially for visually appealing brands and with so many ads in such condensed inventory, the most visually attractive content and with promotions will always win a customer acquisition.

Search is largely where consumers will begin their purchase journey – 57% of consumers rely on Search to help them out when they don’t have a brand in mind.

Holiday related searches began much earlier in 2019 (vs. 2018), and are anticipated to start even sooner in 2020. On average, holiday gifting searches start to rise in September and this year has seen no expectations indicating a need for advertisers to plan early and focus on eCommerce more than ever. One study showed that approximately 23% of shoppers began seeking out gifting ideas 6 months ahead of the holidays.

In order to ensure a successful holiday season, it will be

key for advertisers to adapt to unpredictability, position investment to coincide with consumer demand and boost spend beginning in early September. Many consumers

will want to shop early to avoid items being out of stock and dodge any potential shipping delays. Furthermore, consumers who would have gone in store for Black Friday, will likely shift behavior towards online. October and early- November will be pivotal in triggering that holiday demand through video, discovery, and strong category coverage across search, while mid-November into December will

be key in channeling shopping behavior through video (remarketing & retention) with strong CTAs, search and shopping campaigns.

With the unpredictable holiday season upon us, it will be important to keep the following in mind as you navigate your way through your Google Ads strategy.

Maximize Your Presence

Last holiday season, 89% of consumers searched online before purchasing in-store. It’s now more important than ever to stand out and be present at each step of the user journey and further facilitate an understanding of what your consumers care about and be there to meet them with a personalized, memorable experience.

- Consumers average 140 touch points during their shopping journey, which can influence who and where the consumer ultimately buys from.

- Maximize your brand share of voice to be present and avoid competitors from taking over the space; keep a pulse on this trend to ensure you don’t lose out on hand raisers and prioritize budget against these terms

BOPIS

(buy online pick-up in store) – If you do have the option for shoppers to buy online, and pick up in store, leverage Google’s new ‘curbside pickup’ feature through local inventory ads to highlight consumers options to create a seamless user experience this holiday season;

if you do not currently leverage local inventory ads, these updates can still be promoted through Google My Business

YouTube

Over 70% of viewers say YouTube plays a substantial role in bringing awareness to new brands. During this holiday season, it’s critical to create and leverage inspiring content to be able to stand out and ultimately drive product consideration and brand awareness through a three tiered approach: prospecting, retention and remarketing.

Audience Diversification

Target both 1st party and 3rd party audience data to ensure your promotions are getting in front of the right people, at the right time; this will ensure you are retaining current customers while obtaining new customers.

Layering on audience data will help reduce some of the significant competition that typically floods the space during this time and help combat the uptick in CPCs.

In-Market audiences will play a large role this year to help brands reach new consumers who are actively shopping for products like yours and allow them to discover your brand.

Messaging

Utilize messaging to promote earlier shopping behavior and highlight shipping cut-off dates; this messaging should be present across the funnel all the way down to lower funnel tactics including text ads and ad extensions to reinforce the importance and deliver on a strong user experience

Product Feeds

Maintain product feeds to make sure the consumer is getting the best possible experience and only promote products that are currently in stock; this should trickle down to your text ads as well, although not dynamically updated, making sure your products featured in your ad text are in stock, will be key to seeing strong performance

Call to Action

Use urgency in your ad text by leveraging automation to countdown to the end of a sale; while this may seem like a straightforward approach, it is especially critical during the holiday timeframe in the competitive landscape.

Iterate and Refine

Refine your remarketing strategy to continue reminding consumers about your brand and get in front of them every step of the way. Remarketing can be leveraged across Display, Discovery, YouTube and Search to help re-engage and drive consumers back to site who have already shown interest in your product.

Key segments to use: cart abandoners, site visitors, past purchasers.

Brand Expansion Channels

Over the highest converting peaks of Holiday, one of the better methods for overcoming higher advertising costs is to increase touchpoints with customers who have already engaged with your brand. Essentially, this means that the focus pre-holiday would be to maximize remarketing pools.

While Facebook and search ads can be highly effective from a direct-reponse perspective, they may not be as effective in expanding the reach and household penetration around holiday. For example, introducing a brand to large scale audiences with podcasts, direct mailers, programmatic display buys, or even YouTube can help build potential holiday purchasers. While it may be difficult to jumpstart these efforts if not already on your radar, consider how you can leverage broader reach campaigns for future holidays and key milestones.

Budgeting & Pacing

Budgeting and pacing should be devised by looking at prior year daily sales and media efficiency rates to set this year’s daily revenue goals. Promotional and sales calendars also dictate media and acquisition budgets, requiring budget increases for certain days where brands are expecting promotional demand and higher conversion rates. This is why it is so important for brands to understand their macro Holiday themes and specific day-by-day campaigns as it influences the ebb and flow of the overall media budget.

From Black Friday through the end of the holiday season, we tend to see elevated ad costs,

but also very elevated conversion rates, that give brands an opportunity to drive more revenue than usual. In order to capitalize on the increased conversion rates, it’s important to mitigate the increased ad cost as much as possible.

We recommend investing heavily in prospecting after Labor Day through to the week of Black Friday so that during the big promotional weekend and in December the brand can switch investments over to capitalizing on remarketing pools. This helps mitigate the increased cost of reaching new users during that period.

CRM Checklist

CRM encompasses your brands email, sms and push notifications and customer segmentation. The following are the key items brands should be considering to maximize Q4.

1. Communication Calendar

In alignment with the brands overall Holiday themes and promotional calendar, E-Commerce teams should be mapping our their email campaign cadence, topics and segmentation for each day between now and 12/31/2020. During key promotional days, brands may want to send multiple communications (e.g. non- openers) to drum up additional sales.

2.Campaign Optimization

Brands should be leveraging any Holiday content they have to optimize campaign creative, and to bring a Holiday theme to the Welcome, Abandoned Cart, and Browse Abandonment automation flows.

You want the customer experience to support the Holiday shopping narrative.

3. Segmentation & Personalization

Brands should strive to increase not decrease the amount of personalization during this time. As consumers are inundated with emails, the brands that specifi- cally and efficiently speak to their needs are the holiday winners.

Popular segments for Holiday include:

- Past holiday buyers

- Holiday browsers

- VIPs (+ 3 purchases)

- Past purchasers by product

- Discount purchasers

Web Checklist

Brands should leverage the following checklist to ensure they are ready for the holiday season and that their site-infrastructure can handle increased sessions this season.

1. Site Speed

Aligned to the brands overall Holiday themes and promotional calendar, E-ComWith dramatic increases expected in online traffic, brands should be optimizing any site speed friction points prior to any code freeze. This will improve customer experience and conversion rate.

2. Landing Pages

Brands should consider what landing pages make sense to promote their Holiday themes and products. These landing pages can be used to better convert email and paid media traffic by creating a more seamless user experience around Holiday shopping.

3. Payment Options

In addition to being more deal savvy, customers are also looking for more payment options, including installment plans. There are many providers like AfterPay, Klarna, and Affirm that offer these installment payments for customers.

Consider the applicability of these payment options for your brand entering this Holiday season to maximize customer conversion.

4. Code Freeze

Brands should be planning to wrap up all development activities and have a period of no development activity from early November through shipping cut- off dates in December. This helps mitigate any development risk impacting key promotion dates like Black Friday and Cyber Monday.