So Tiger and Nike’s decision to end their partnership wouldn’t normally prompt a note from me but there are actually some very intriguing business fundamentals to explore so I thought it was worth a post.

Tiger recently announced he was ended his long-standing relationship with Nike (27 years) and would be wrapping up his recent contract — his last contact with Nike was signed in 2013 and estimated to be valued at $200m (20m a year).

My sense is the decision was largely mutual but more will come out.

So what’s next for Tiger?

When the rumors were raised a few weeks back, my instinct was Tiger would want to start/further develop his own brand versus sign on as a partner for another brand. I had this thought in part because I’m not sure another company would pony up $20m + for his services and also because the approach to own ones ‘brand’ seems to align with Tiger’s interest and the broader trend around celebrities really taking market share in the fashion & apparel space.

Side-Note: I recently spoke about the trend of influencers/celebrities continuing to take market share in the fashion & apparel category. I’m not convinced that every celebrity can brand around its name and have a financially successful clothing brand. It’s much more nuanced. I tend to think the Kardashian Skims play is often the better model because while she is clearly connected to Skims in an organic way, she isn’t the sole founder and it’s not all about her likeness. I’m likely going to talk more about what these celebrity-driven trends mean for brands at large in the coming weeks.

Fast forward to today: while this hasn’t been confirmed…based on initial reports, it does seem like Tiger will be doubling down on the TW brand and launch his own clothing line.

In thinking about this, I started to wonder— is this actually a business savvy move?

Can Tiger make more from his own clothing line than he would otherwise earn in similar endorsement value?

Let’s explore things in more detail to find out.

As a starter, let’s say $20m is his comparable annual endorsement value while also assuming Tiger’s new brand will be launched around his likeness.

- While it’s appealing to have brand control for obvious reasons, I’m not so sure a TW apparel brand will have the mass market appeal needed to drive a multi-billion valuation. Do enough people in the sport of golf want to wear TW branded clothing – let alone outside of golf? It’s one thing to wear the Nike swoosh on your chest and another to wear a TW on it.

- Excluding the equity value for a second, realistically Tiger’s clothing brand would need to generate $200m + in revenue and be financially sound to drive similar profits to what he was earning in a sponsorship. That seems challenging in the near term.

- Tiger doubling down on a TW branded clothing line is different than say Tom Brady’s approach with his Brady brand (which I don’t believe is doing great by the way) because Tom Brady has more mainstream fitness appeal. I’m not sure who Tiger’s core customer would be at this stage of his career or what clothing products he would focus on. Tiger selling golf products like clubs or balls would be a different story — though that’s much more niche.

- Athletic fashion (presumably his market) is typically low to moderate margin so despite some of the sexy trends you see make headlines, expecting a sustained valuation north of 2x revenue would be a challenge. Given that, Tiger would probably want a valuation of $500m + (revenue of $250m +) to justify the significant investment that will take place and the loss of fixed sponsorship income. If the average golfer spends $500 on clothing a year, he would need 500k customers to generate $250m in revenue. To achieve those results, he would need to gain market share on a pretty high concentration of male golfers (likely his target market).

- It’s possible that Nike’s renewal offer was significantly below the $20m a year he was assumed to recently be making (which all things considered was pretty good ROI for him given his limited number of events) so that would be a reason for branching out. And either way, I know Tiger’s deal isn’t what Jordan’s is with Nike in terms of rev share and overall value (though I think there’s a reason for that).

- I know some were speculating he might sign with Greyson (Charlie appears headed in that direction) but I don’t think Greyson has the cash or resources to support Tiger so that would be a surprise to me.

- Certainly, there could be other factors at play in Tiger’s desire to maintain brand control (more autonomy, long-term upside, the ability to sponsor/sign other athletes, non-clothing potential). I didn’t explore all of these possible benefits in this piece.

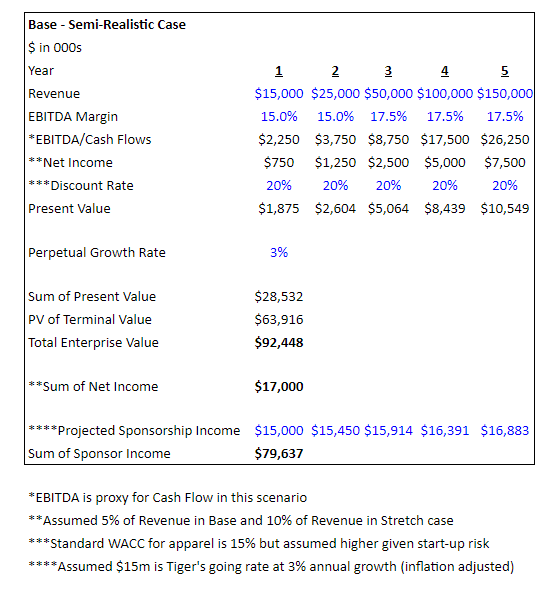

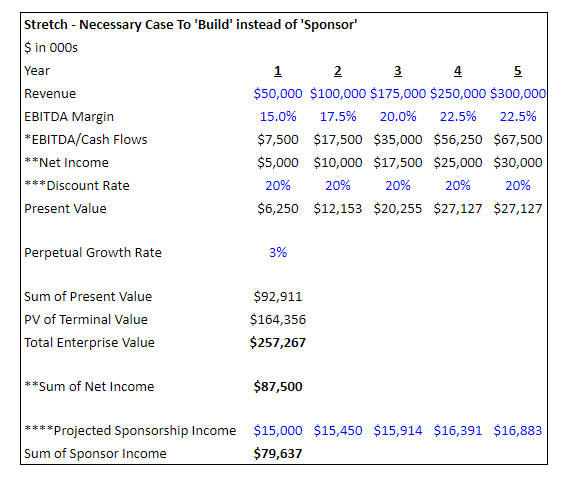

I built a simple DCF/IRR model demonstrating the value he would need for ‘building his own brand’ to be the right decision from a financial perspective (which will be very challenging to accomplish as the numbers demonstrate).

If I were Tiger, I would maintain a sponsorship with the right partner (assuming financials are the goal) but continually explore additional ways to monetize my brand outside of clothing for now. I’m not saying he can’t make a successful clothing brand work but it will require a very thoughtful approach for capturing mass market appeal (outside of golf) to generate a greater return than the sponsorship value – especially when you likely adjust for upfront capital, time and opportunity cost.

In any event, I’ll be monitoring closely and I’m excited to see how this plays out!